How many commissions can the bank charge me?

According to the Bank of Spain “credit institutions are free to establish their bank commissions and reimbursable expenses as long as they respond to services actually rendered or expenses incurred" ; in addition to noting that " may not charge bank fees or expenses for services not accepted or requested by the client, nor charge two or more times for the same concept."

This means that, from the moment we carry out any action with our bank, we are liable to be charged for anything. This supposes the total and absolute free will in the field of bank commissions. However, in any case we will have to be notified of this charge and its concept.

What are the most common commissions?

Bank fees are a decisive aspect when hiring a bank product. Whether it is a checking account, a mortgage or a personal loan, we must pay attention to the inherent commissions. Regarding bank accounts, in any entity we can find 4 types of commissions :

- Maintenance fees. They are charged by the entity for having an open account.

- Administration commission. This in particular can become excessive, since it charges for each movement that we make in our account.

- Transfer fees. They consist of the prices that we will pay to issue transfers.

- Commission inherent in the card. They can charge us for the issuance, maintenance and renewal of our bank cards.

What other commissions are there?

As we already know, each bank can charge for any concept it wants. Although, the Bank of Spain establishes some limitations to this discretion. The first limitation is that this concept represents a service that has taken place effectively. The second limitation is that we are not charged twice for the same reason.

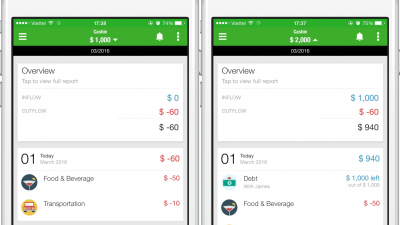

We can highlight another type of commission. This would be the set of overdraft fees , which will be charged to us the moment our account falls in the red.

This is a triple commission that is structured in three parts:

- For claiming debtor positions : the bank will charge us for the mere fact that we are in the red.

- Commission on the overdraft : the entity will charge around 5% APR on the overdraft, although with a minimum of around 15 euros, at the time we become overdrawn.

- Interest on the overdraft : it is an interest on the negative amount, as if it were a credit that the bank has granted us.

Where can we consult the commissions?

As established by the Bank of Spain (BdE) , credit institutions are required to make all information regarding bank fees public and accessible. If we want to know the cost of operating our bank account or how much we must pay for the products that it has associated with it (credit and / or debit cards, check books, etc.), we can consult this information on the bank’s rate board, which we can locate both in any office of the entity and on its website.

Important aspects of bank fees that we should know

- As we have already mentioned, banks can charge us commissions for any service provided and set the price that they consider appropriate. But we must be clear that they are obliged to inform us of these rates (let’s not forget the fine print). In addition to this obligation, they must notify us of any modification that the commissions may undergo at least two months in advance.

- Banks can not charge us twice for the same service.

- The cost of some bank fees is limited by law. For example, if we decide to cancel a fixed-term deposit in advance, the penalty that the bank applies to us can never be higher than the gross interest that has been generated to date.

Is it possible to recover the bank fees that we have already paid?

Yes, it is totally possible to recover the amount that we have paid as commissions. Although it is true that it is not a simple procedure. In fact, we will surely have to negotiate with the office staff. To recover this money it is very important that our request is well justified. In addition, it will be essential that no more than 12 months have elapsed since we paid the commissions whose return we request.