LoanDepot Mortgage

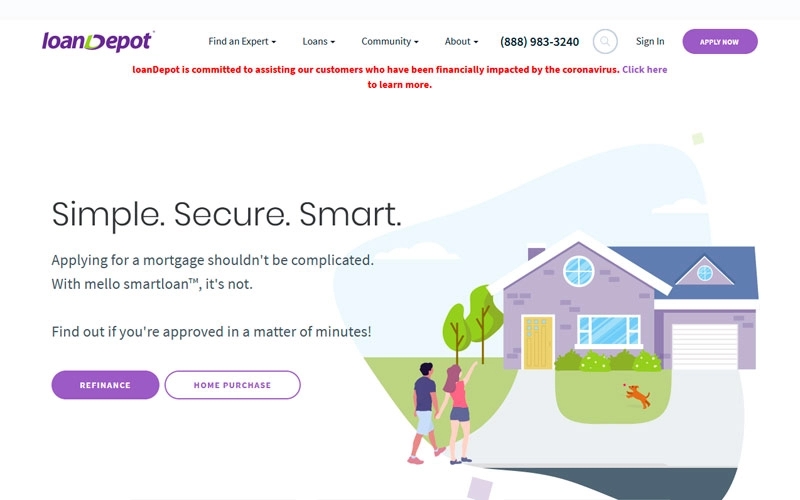

LoanDepot is a major nationwide lender with a variety of loan options that can meet almost any customer’s needs. LoanDepot has an abundant and robust online presence. You can apply in person, from your phone, as well as your computer and conduct the entire process online. Their preferred method seems to be by phone – they pride themselves on their “high touch” service. There are many resources to help any borrower on their website, which is www.loandepot.com/.

In addition to home purchases, LoanDepot also refinances properties – you can get a “rate and term” (also known as no-cash out) refinance, or you can take equity out of your home with a cash-out refinance. They do interest-only loans and construction loans, as well.

For those who don’t own a home or need a mortgage, unsecured personal loans up to $35,000 are available. This is highly unique in the industry.

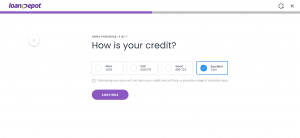

LoanDepot is best suited for the borrower who can deal with technology and who meets reasonable standards for credit score (620 – 850), can qualify based on their income and demonstrate down payment and reserve requirements for LoanDepot’s programs.

LoanDepot Experience & Satisfaction

LoanDepot is a US residential mortgage company, headquartered in Foothill Ranch, California. The company operates a number of retail branches and does business in all 50 states, Washington DC and four territories (American Samoa, Guam, the US Virgin Islands and Puerto Rico).

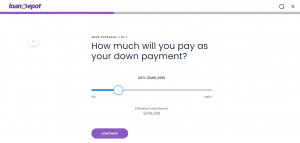

You do not have to have the highest credit scores or significant cash down payment for their loans. LoanDepot has a solution for most borrowers, including some that require no cash down.

In 2017, LoanDepot ranked 2nd in overall funded mortgage volume among the top 75 lenders, according to respected industry publisher the “Scotsman Guide”. Their 6000+ employees closed over 136,292 loans and a total of over $35 billion in volume out of 180+ locations. The majority – approximately 85% – was retail volume, where they originate and close the loan directly with the customer.

LoanDepot is committed to leading the lending industry into the next generation of modern lending, which will be the result of making significant reinvestments in proprietary technology. Their marketing platform, credit and risk models, and dynamic product delivery systems empower consumers with access to credit.

Diversity: products for different types of borrowers, including bad credit/no history

Friendly online portal, cutting-edge technology

High customer satisfaction

Cons

Turnaround times are usually 30-45 days

Loan Processing is centralized, which can result in service issues while in the process

Doesn’t offer programs for bad credit borrowers

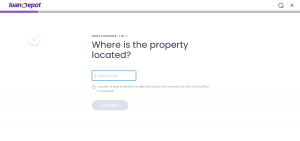

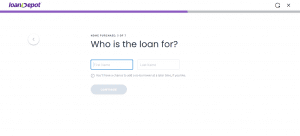

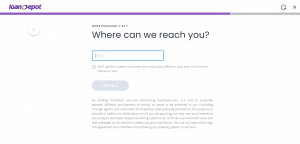

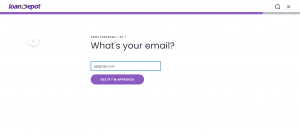

Application Process

LoanDepot’s web site is short on explanation about the process, but offers and extensive “Knowledge Café”, where you can learn the basics about what to do and not to do, an explanation of terminology, what to expect in the process, etc.

There are eight calculators where you can determine whether a Fixed or an ARM loan is best, a payment calculator, an FHA Calculator, a VA Calculator, an interest savings calculator (when refinancing), an affordability calculator, and more.

The following description of the process could be useful, considering that the process is nearly the same across lenders and technology platforms:

1. Get organized – track down your income documentation, bank statements and other legal documentation that will be needed during the process.

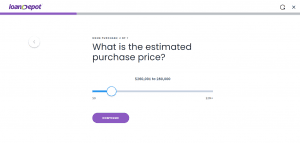

2. Think about your budget – start with your salary, self-employment or other income, multiplying it by 29%. The goal is that your total housing expense would not exceed 29% of your gross income. In fact, the agencies and LoanDepot will approve loans with housing expense greater than 29% of your monthly gross income, but that is a good place to start. At this point, engage the services of a professional loan officer, who can help guide you through income qualifying.

3. Apply for a mortgage and get pre-approved. This will tell the seller you are serious and will assure the seller that you will be able to close on the agreed terms.

4. Prepare for the appraisal, processing and underwriting of your loan. Most of this work is done by LoanDepot, with you supplying documentation as it is requested.

5. Your loan goes for final approval – if approved, you will sign the final closing documents and will become a homeowner

LoanDepot Mortgage FAQs

Is LoanDepot a Good Choice for Mortgages?

LoanDepot can service borrowers who prefer in-person, online only, or hybrid experiences, as well as those who need a variety of loan options.

And with over 200 branch locations and its mello smartloan software, it’s ideal for borrowers who require both flexibility and reliability.

What Types of Mortgages Does LoanDepot Offer?

LoanDepot offers both fixed- and adjustable-rate conventional, jumbo, FHA, and VA mortgages. Borrowers can also refinance their existing loans.

And while LoanDepot purports to have home equity loans upon request, borrowers may be steered toward a cash-out refinance, instead.

Does LoanDepot Offer Mortgage Refinance?

LoanDepot offers mortgage refinance for conventional and jumbo loans. Borrowers can also take advantage of VA, FHA 203(k) renovation, and cash-out refinance loan options.

And if you’re refinancing the same loan you bought with LoanDepot’s mortgage services, you might qualify for a fee waiver through the lender’s Lifetime Guarantee.

Is it Safe to Use LoanDepot?

LoanDepot maintains an A+ rating with the Better Business Bureau and uses its mello smartloan system to verify and secure your information. It’s as safe as a hybrid mortgage lender gets!

What Credit Score Do You Need to Qualify for a LoanDepot Mortgage?

To qualify for a conventional loan, you’ll need a minimum credit score of at least 620 and a down payment of 3-5%.

However, government-backed loans serviced by LoanDepot may come with lower credit and down payment requirements.

Where are LoanDepot Mortgages Available?

LoanDepot is licensed to originate mortgages in all 50 states.

Who is LoanDepot Best For?

LoanDepot is best for borrowers who need flexibility, reliability, and a quick closing period. And while the lender services borrowers who need a variety of fixed- and adjustable-rate loans, the place it really stands out is its refinancing programs.

Bottom Line: LoanDepot Mortgage Review

LoanDepot is a solid lender than offers borrowers flexibility in how they go about their mortgage process.

With their mello smartloan program, Lifetime Guarantee, and 200 branch locations, you can get started anytime, anywhere, and pick up where you left off with ease.

Whether you go from application to close entirely in pajamas or stop in at a branch for a face-to-face experience, the choice is yours.

But LoanDepot isn’t right for everyone. You’ll want to consider whether their higher-than-average rates and fees are worth it for you, or if you’re getting a better deal than you would elsewhere.

And if you’re not planning to refinance in the future, you might ask if their Lifetime Guarantee is enough to keep you around.

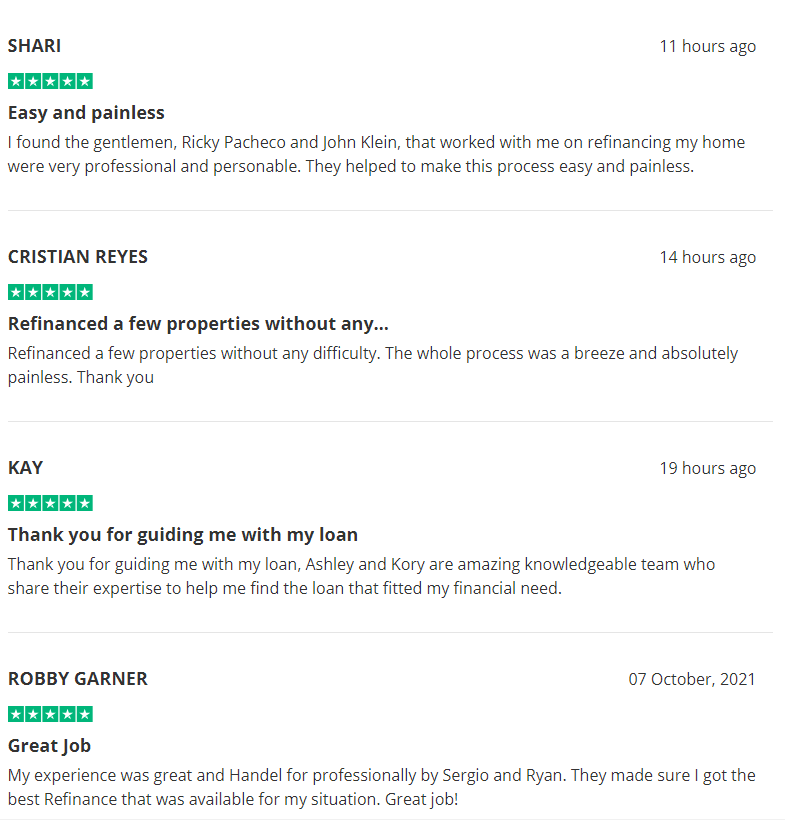

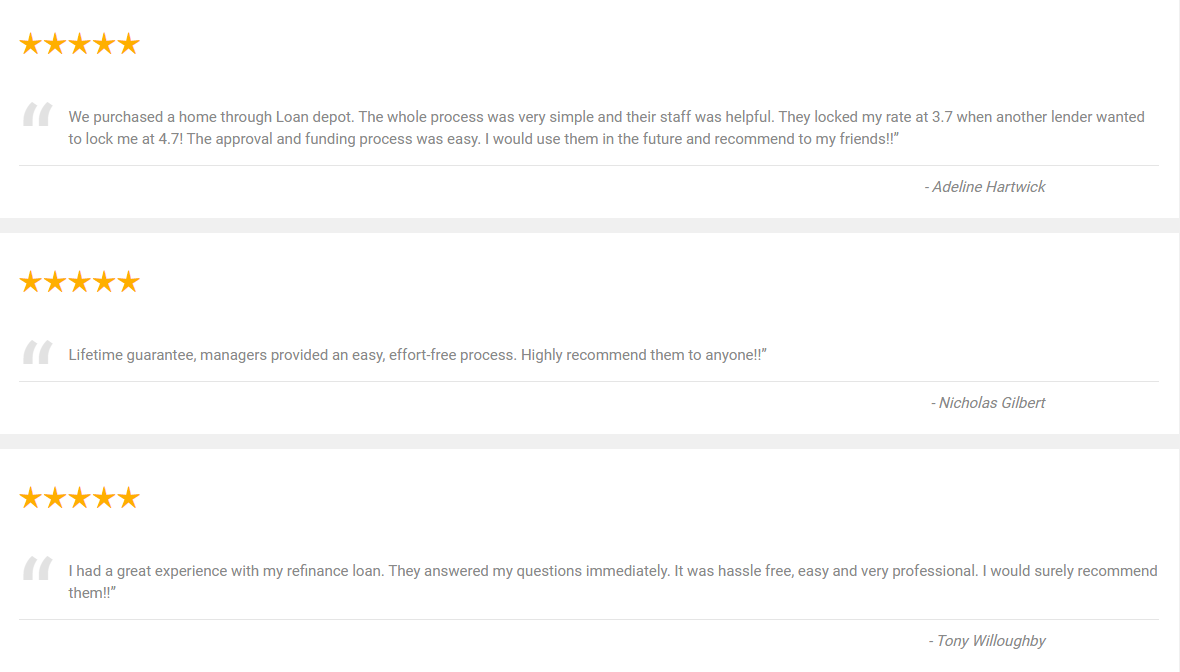

LoanDepot Reviews