Next Insurance Review

Small business insurance is essential if you want to protect your finances and reputation. As a result, it’s vital to find the right coverage at a competitive price.

Next Insurance offers policies that will financially protect your company from injuries and accidents. You can purchase same-day coverage for your local or online business in just 10 minutes.

This Next Insurance review evaluates the provider’s coverage options and helps you decide if it can meet your insurance needs.

What is Next Insurance?

Next Insurance offers business insurance policies for online and physical small businesses as well as those who are self-employed. It is licensed in all 50 states and the District of Columbia.

You can complete the entire registration process online and receive quotes instantly.

This provider issues every policy you purchase and also handles your insurance claims. The carrier states that they make most claims decisions within 48 hours.

In addition to underwriting your small business policy, Next Insurance has an “A- Excellent” rating from AM Best. This is the rating agency’s second-highest score.

Overall, Next Insurance has an excellent ability to pay ongoing insurance obligations. It is a legitimate option for protecting your business.

Types of Business Insurance

This insurance carrier offers over 30 policy types to help small businesses.

Some of the most popular options include:

| Coverage Type | What It Covers |

| General Liability | Bodily injury, property damage, medical payments, advertising harm, court and legal fees, libel, slander and defamation |

| Professional Liability | Business errors, missed deadlines, accusations of negligence |

| Workers Compensation | Medical expenses, lost wages, survivor benefits, retraining, permanent injury, employers liability |

| Commercial Property | Business goods and gear, inventory, buildings, equipment breakdowns, business income interruptions |

| Commercial Auto | Underinsured motorists, rental reimbursement, towing and labor, collisions and comprehensive coverage, injuries, property damage |

| Hired and Non-Owned Auto | Rental vehicles, personal vehicles, property damage, legal defense |

| Tools and Equipment | Damaged equipment, stolen tools, borrowed gear |

| Errors and Omissions (E&O) | Business mistakes, accusations of negligence, missed deadlines |

| Liquor Liability | Injuries, property damage, legal fees, medical payments |

| Business Owner’s Policy (BOP) | Property damage, injuries, court and legal fees, business income interruptions, advertising mistakes, inventory replacement |

| Business Insurance | Property damage, injuries, lost wages, defense costs, vehicle accidents, business errors |

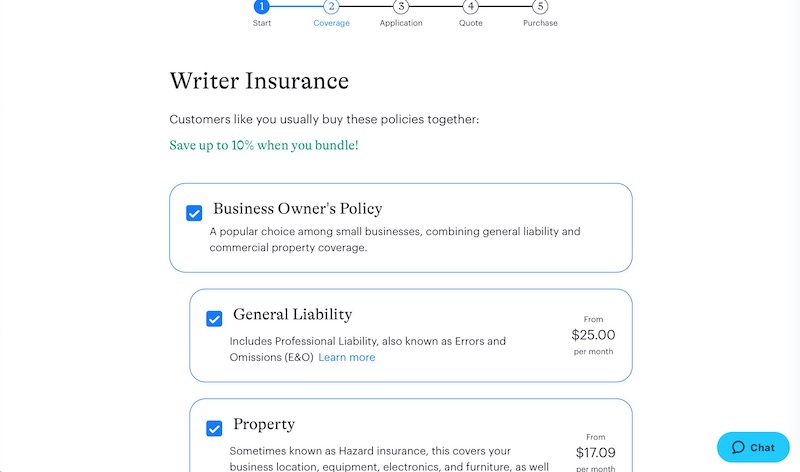

Bundling multiple policies lets you receive up to 10% off of your monthly premium. Additionally, you may qualify for other discounts to reduce your rates.

Eligible Businesses

Over 2,500 business categories are eligible for coverage from Next Insurance.

Some of the most popular niches include:

- Amazon sellers

- Auto Service

- Beauty

- Cleaning

- Contractors

- Construction

- Education

- Engineers

- Entertainment

- Food and Beverage

- Fitness

- Real estate

- Restaurant

- Retail

During your insurance interview, you can pinpoint your occupation for relevant price quotes.

These business structures can apply for coverage:

- Individual/ sole proprietor

- Partnership

- LLC

- Corporation

- Trust

- Non-profit

How Does Next Insurance Work?

Here is a step-by-step look at how Next Insurance works.

Online Insurance Interview

The first step is creating a free account with your email address to start the interview process. You can access the platform using a web browser or the mobile app.

Then, you can share your profession, state of residence and business details (such as income, asset values and the number of employees) to start comparing your coverage options.

During the interview, you’ll be asked the usual questions. These include your history of business insurance claims and if another provider has dropped you. Any legit online or local insurance carrier asks these questions.

You will see initial price quotes for these products:

- General liability

- Property (hazard insurance)

- Workers compensation

- Commercial auto

As you progress through the interview, you can add additional endorsements. One example is getting Errors and Omissions coverage if you’re a financial advisor or a consultant.

The online interview can take less than 10 minutes. This might be quicker than meeting with a local agent.

Online chat and phone support are available if you have questions about your coverage options.

Policy Exclusions

One area where Next Insurance shines is its effort to be transparent about uncovered events during the interview process. It can be easy to overlook these situations if you’re trying to get a quick quote.

You will also see a list of the most common exclusions before viewing your insurance quote.

Some of the uncovered situations can include:

- Subcontractors with smaller coverage amounts than yours

- Work related to specific topics

- Subcontractors don’t have every required license

- Damage to vehicles, tools or customer property

Additional insurance like professional liability or commercial auto can cover general liability and property exclusions.

You can always speak with a Next Insurance licensed advisor before purchasing coverage if you have questions.

Get Instant Coverage

After completing the interview, you can buy same-day coverage or start at a future date.

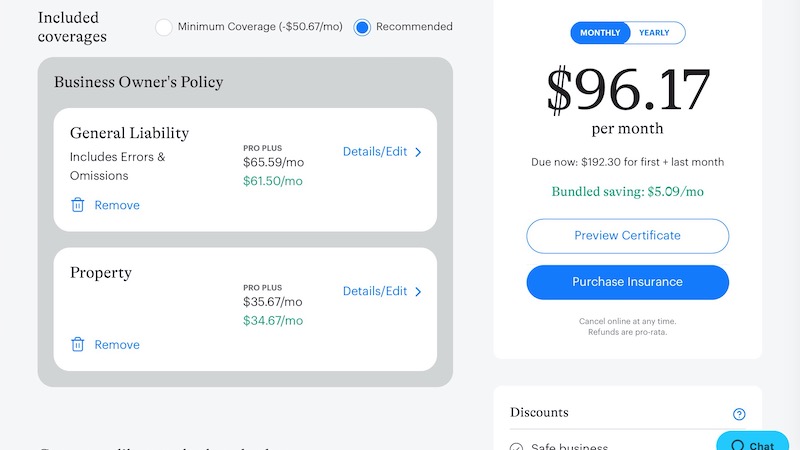

You will see a policy with recommended coverage amounts and applicable discounts. It’s possible to customize your policy benefits or drop to the minimum coverage to get the ideal protections for your preferred budget.

The service also lets you preview your insurance certificate for potential coverage gaps. You can use this opportunity to compare your existing certificate to this sample if you’re comparing rates.

If you’re not ready to buy insurance just yet, you can save your quote. The platform lets you email the quote to your agent to compare prices easily.

On-Demand Policy Modifications

Once you have active coverage, you can effortlessly modify it and add additional insured parties at any time.

The online platform previews your new insurance rate before implementing the changes.

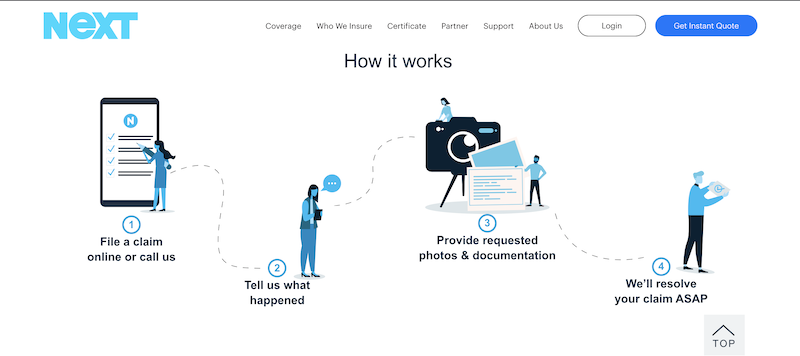

Filing a Claim

It’s easy to file a claim with Next Insurance. Simply log into your account online or call the company to inform them of your claim. Then, provide the necessary supporting materials.

Next Insurance will resolve your claim as quickly as possible.

While most claims are paid out via check, some can be paid using direct deposit.

How Much Does Next Insurance Cost?

Prices can vary based on your needs. Fortunately, it’s free to request quotes from this insurer.

Your first and last month’s premiums are due upfront. After that, you can make monthly payments for the remaining balance.

Your monthly and yearly pricing depends on several factors, including your:

- Business type

- Location

- Coverage amounts

- Deductible

- Policy types

- Previous insurance history

There are three pricing tiers. These include Basic, Pro and Pro Plus. Each one has different per incident and per year coverage amounts.

Most products start at $20-$25 per month for minimal coverage. However, you could pay as much as $95 if you choose the most extensive coverage.

As a reminder, Next Insurance isn’t an insurance marketplace that offers policies from several carriers. It’s wise to obtain quotes from several carriers to compare premiums and get the best rate.

Insurance Discounts

You might be eligible for multiple discounts that reduce your premiums.

Next Insurance offers the following discounts:

- Bundling discount (up to 10%)

- Established business

- Claims-free history

The carrier states that your discounted rate can be up to 30% cheaper than competing policies.

Insurance Cancellation

It’s also affordable to cancel your coverage before your policy renewal date. Early cancellations are penalty-free.

If you decide to cancel early, you will receive a prorated reimbursement for your remaining premium.

Key Features

Here are some of the best reasons to use Next Insurance.

Instant Quotes

Being able to request quotes instantly makes the insurance process hassle-free. Other insurance companies may have you speak with an agent for a ballpark estimate.

With Next Insurance, you have full customization options to pick your ideal policy at any time without needing to talk to an agent.

Unlimited Certificates

You can easily add third parties and obtain proof of insurance certificates from the website or mobile app. This feature is available 24/7.

Better yet, you can email your credentials directly to others. This electronic evidence lets you quickly help vendors and clients who need this documentation.

A traditional insurance agent can take several days to process your request. It can also be more challenging to obtain a copy of the certificate.

Licensed Advisors

While you can purchase your entire policy without speaking to an agent, you do have access to a licensed advisor.

These United States-based advisors are available by phone or online chat. They can help answer your questions about coverage and claims.

Quick Claims Processing

Most Next Insurance claims are processed within 48 hours. Other agencies may take up to 15 days to finalize similar claims.

You and non-policyholders can also file a claim online or by calling an agent.

100% Online Capabilities

Next Insurance is entirely digital. You can open a policy and manage it online or through the mobile app.

You might prefer this provider if you want to avoid calling or meeting your insurance agent each time you need assistance.

However, you do have the option to call a Next Insurance representative if you need help filing a claim.

Next Insurance Reviews

If you are on the fence about Next Insurance, knowing what current customers have to say about the insurer can help you make a decision.

Here is how the company ranks on the various rating websites:

| Website | Rating | Number of Reviews |

| Apple App Store | 4.8 out of 5 | 25 |

| Better Business Bureau | 4 out of 5 | 75 |

| Google Play Store | 3.99 out of 5 | 29 |

| Trustpilot | 3.3 out of 5 | 1 |

Here are a few reviews, both positive and negative, from Next Insurance customers:

“Next is very affordable, convenient and the best insurance for my business. I’m glad I found you guys! Customer service is great. And you can do add-ons to your major plan!.” — Brett C.

“Affordable commercial auto and general liability insurance with the simplicity of doing everything online. I love being able to get an immediate certificate of insurance to send to my customers via email and add them as a certificate holder with ease!” — MisterDetail1

“I spent 20 minutes asking all their questions, then they said they could not insure me due to THREE answers to my questions that were at the END of the interview. They need to ask these questions UP FRONT and tell the user right away they are disqualifying.” – Phil K

Next Insurance Alternatives

You may consider getting business insurance quotes from other providers if you aren’t sure about Next Insurance. Here are some of the top alternatives.

Thimble

Thimble provides similar coverage options as Next Insurance. You can complete the quote process online in minutes.

With Thimble, businesses in the following industries can get coverage:

- Contractors and handymen

- Entertainment professionals

- Fitness and personal trainers

- Landscapers

- Pet sitters

- And more

This platform also lets you purchase on-demand event insurance and drone insurance. Other services may only offer ongoing business purchases, which may not cover certain one-time situations.

Trustpilot score: 4.6 out of 5

Hiscox Business Insurance

You can get online quotes or speak with a licensed agent through Hiscox Business Insurance.

This service offers more add-on insurance products, such as:

- Cybersecurity

- Umbrella

- Directors and officers

Hiscox provides coverage to over 180 different professions. Freelancers and larger businesses can choose customizable policies.

You may prefer this company since they have been in business for over 100 years.

Trustpilot score: 4.6 out of 5

CoverWallet

CoverWallet offers extensive commercial insurance coverage options for small businesses. Sole proprietors can also obtain coverage.

This insurer works with the following business types:

- Accountants

- Beauty Salons

- Contractors

- Healthcare

- Restaurants

- Truckers

- And more

You can get free online quotes and speak to licensed advisors by phone. The service even lets you instantly get your insurance certificate and obtain additional coverage without an agent.

Trustpilot score: 2.5 out of 5

FAQ

These questions can help you decide if Next Insurance is the best option for your business insurance needs.

Is Next Insurance legit?

Next Insurance, Inc is a legit company which has an A- rating with AM Best which is the industry standard for rating insurance companies. Their National Association of Insurance Commissioners number is 16285.

Does Next Insurance offer business umbrella insurance?

Next Insurance doesn’t offer standalone business umbrella insurance. Regardless, its various liability, property and auto policies can provide sufficient coverage.

Business umbrella insurance provides additional peace of mind. That said, it can be an unnecessary cost for certain businesses.

Does Next Insurance have an app?

Yes. Next Insurance offers a free mobile app. It’s available for Android and Apple iOS devices.

What are the Next Insurance customer service options?

Licensed advisors are available by phone for policy questions and claims from 6 a.m. to 5 p.m. Pacific Monday through Friday. Online support articles are also accessible 24/7.

Summary

Next Insurance can fulfill your business insurance needs at a competitive price. You may appreciate this platform since you can obtain coverage online within minutes and still have access to an agent.

Buying small business coverage from Next Insurance is convenient in many aspects. However, you may prefer the hands-on help of a local agent for personalized service.

Ultimately, the right business insurance company for you depends on your specific needs and budget.