January can be an unkind month for most of us. We return to the routine after the Christmas celebrations; Soon our New Year’s resolutions tend to dissolve in the coming and going of the days and our finances tend to suffer from the expenses of December. We call that return to reality that is difficult for us and that is going uphill for us precisely the cost of January.

Financially, the January cost can be especially tough. Not only that, but starting the year with financial problems can generate a spiral of difficulties that we drag throughout the year that we have just started. We are going to see some of the most typical errors and the best solutions to avoid or fix them.

Errors when we face the January cost

1. Don’t take the January cost seriously.

Yes, we know that returning to reality after the Christmas holidays is not a tasteful dish. But denying difficulties does not help to solve them, but the other way around: it reinforces them. Many people prefer to be carried away by the Christmas dynamics and do not accommodate their expenses after the holidays. This way, the hole they make in their finances is bigger and it will be more difficult to fix when they finally want to.

2. Defer the arrival of austerity.

This second error is closely related to the first. Many people consider that the year is long and that there will be time to “tighten the belt”, but, even if they have that in mind, they feel that they need a few weeks of relaxation before facing the problems. In the end, the end of the month is coming soon and the year has already started and it seems that our finances are turning red for the whole year. It is always a mistake to let the problem grow instead of facing it.

Because of this tendency not to face expenses until we see them, for example, in the settlement of our credit card, it is why Blue Monday, considered the saddest day of the year, is so related to the cost of January and its financial consequences.

3. Request a loan to cancel another.

These refinancing operations must be carried out very carefully. They can be positive if they are well planned, but they can also be like a growing snowball that becomes increasingly difficult to manage. Therefore, if we have reached that situation in which the only way to face the previous loan is to request successive loans, this is undoubtedly a sign that we are not managing our finances in the ideal way.

As we can see, the most typical errors have a psychological basis above all. We are lazy and we find it difficult to confront situations that we do not like. We tend to prefer to ignore them until we can no longer do so because they have become too serious. It is, therefore, a matter of self-discipline.

The example would be that of the person who is neglecting their body and diet. She knows she has to take care of herself and exercise and eat better, but she is bored by trying hard and cooking healthy; She prefers to eat ultra-processed foods and enjoy the sofa and television, even knowing that this is bad if it becomes routine. Until your body does not scare you, either because it is aesthetically deteriorated, or, worse, because a health problem occurs, no, it faces reality. You have preferred your momentary false well-being over your true future well-being. The same thing happens with the accumulation of debt.

Let’s take a look at some of the simple and smart ways to make the January cost more bearable:

4. Reuse what you can of Christmas.

Let’s be honest: at Christmas we eat much more than we need, but we cook even more than we eat! Nothing happens if part of all that food is reused as much as possible. It will surely continue to be delicious and will help us save a little in the supermarket the first few days. It may not make a big difference when it comes to money, but it is the right gesture to put our minds on the alert and on the path of austerity. And sometimes, these little details are what prepare us and lead us to the most complicated decisions.

5. Take advantage of sales.

Many shops liquidate gender in January and launch good offers with price reductions. It is something you can take advantage of, but be careful. Anything you buy that you don’t need will be an unnecessary expense, and that’s something that will compound your financial problems. If not to buy really useful things that you need, the sales, instead of your allies, can become your enemies.

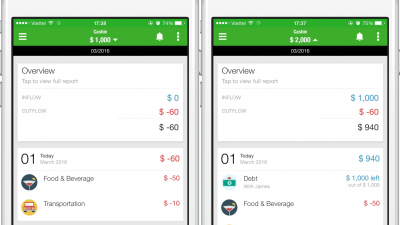

6. Check the Christmas expenses as soon as possible.

Dont wait. It will not be pleasant, but the sooner you know your situation, the better and sooner you can act to improve it. This tip is especially helpful if you didn’t budget for Christmas spending. Write down your expenses and if you have incurred debts, check their amount and how to face them.

7. If you have debts, try to reunify them.

If you have, for example, several credit cards and have spent with all of them, try to unify the debts into the one that charges you less interest and provides you with better payment conditions: for example, if it allows you to defer the debt for several months to do it more bearable without involving a large rise in interest. If you have several loans and think you can pay them off by asking for a new loan, it can be a very interesting refinancing operation. Our loan comparator is ideal for you to know your best offers.

8. Sell things you don’t need.

The start of the year is a traditional home cleaning date. If you can get rid of some items by selling them, even if you are making little money, you will again take a step forward, even if it is not so much on a financial or psychological level.

9. Keep your motivation high.

Remember that it is not just about getting through January, but about getting your year, or what is the same, your life on the right track. Debts change our lives for the worse and paying them off changes us for the better. Your new year deserves a better and more relaxed life. Think about it when you find it difficult to plan your financial organization. It is worth it and the habit will make you more careful and organized.